Retirement Planning Fundamentals Explained

9 Easy Facts About Retirement Planning Explained

Table of ContentsSome Known Incorrect Statements About Retirement Planning The Facts About Retirement Planning RevealedNot known Details About Retirement Planning An Unbiased View of Retirement Planning

There is additionally a particular advantage of feeling monetarily secure that aids people make far better decisions in the existing minute. If you don't believe it, simply consider how you could feel if you were greatly in the red (specifically bank card debt). Equally as being caught under the burden of corrective rate of interest settlements makes it tough to think and also prepare plainly, however having a large nest egg for the future will really feel like a breath of fresh air throughout your working years.

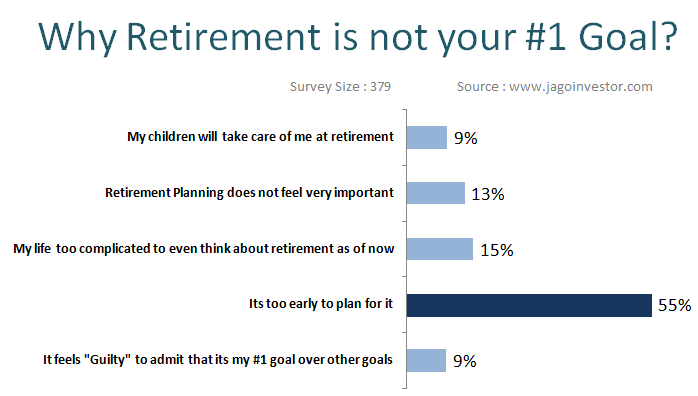

There's no embarassment in counting on household participants when you actually require them. Nonetheless, in America there is a whole range of viewpoints on ideal limits with prolonged member of the family and in-laws. You can not (or need to not) anticipate to depend on your kids to look after you financially or in reality.

It is very important to bear in mind that by the time you retire, your youngsters may have youngsters of their very own that they need to sustain, which means that if they also require to support you, you're putting them into something famously called the Sandwich Generationa group "sandwiched" between the financial duty of looking after their children as well as taking care of their parents.

7 Simple Techniques For Retirement Planning

With a retirement plan in place, published here you'll have even more cash to offer as you obtain prepared to leave a tradition. Having a retirement in position may not be the point that solutions your marital relationship, yet it can certainly help. As you could guess, more information national politics, affection, youngster rearing, and also cash are among the greatest instigators of disagreements in a couple.

Don't place the financial safety of your gold years off any kind of longerroutine a complimentary consultation with an Anderson expert today! - retirement planning.

Here are several of the major reasons that retirement preparation is crucial. Read: 10 Creative Ways to Make Money After Retirement Rising cost of living is driving the cost of living to new heights; today's regular monthly budget plan will certainly not suffice to cover your regular spending plan in 25 or 30 years when you retire.

The investments need to be long-term and relatively low-risk that can withstand economic crises, like realty and also federal government bonds. Discover Extra >> Increasing Inflation: Where Should You Maintain, Invest Your Money? While the majority of employees choose to work till they hit the necessary retired life age of 60, sometimes, these strategies can be shortened.

The smart Trick of Retirement Planning That Nobody is Discussing

You can duplicate your effective retired life financial investment strategies in your other investing objectives, such as purchasing a house. Preparation for retired life will certainly help prepare your estate to align with your life tradition.

Spending in real estate and getting life insurance policy can leave your dependents financially established after you are gone. After retiring, the best point you can do for your family members is not concern them financially.

You ought to be the individual assisting your children check my blog pay for your grandkid's education and learning and such. Retirement planning will certainly assist you produce safety webs from where you will certainly be producing revenue after retired life to sustain yourself and also not burden others with your monetary demands.

Without adequate preparation as well as financial planning, it can feel like prison. Planning for retired life can help you manage to accomplish points and accomplish dreams you could not while working.

The 10-Second Trick For Retirement Planning